According to foreign media reports, data shows that the delivery time of the semiconductor industry has been shortened for 9 consecutive months, indicating that the crisis of "core shortage" for about two years caused by the COVID-19 has passed。

The industry is well aware that in the past few years, most of the driving forces behind the global efforts to boost chip manufacturing capabilities, such as the allocation of US $52 billion to expand domestic chip manufacturing in the United States last year, were due to a two-year chip shortage caused by the COVID-19 pandemic. However, last year's shortage quickly turned into oversupply, reducing the demand for additional capacity.

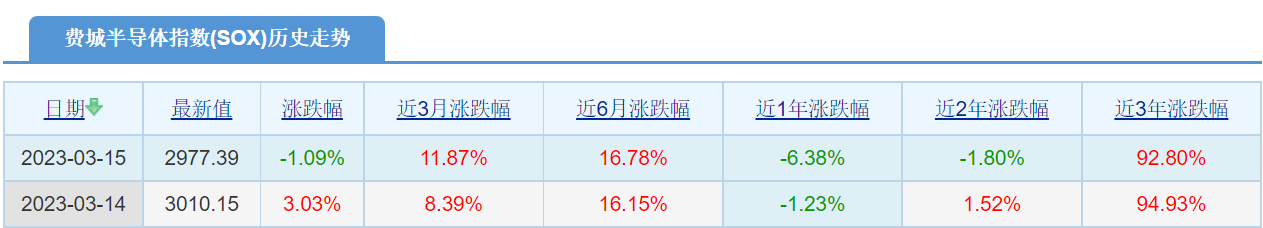

However, as chip manufacturers release their order capacity more quickly, Christopher Rolland is concerned that this change may trigger the cancellation of some orders. The negative news hit the weak trend of US semiconductor stocks on the 15th. The Philadelphia Stock Exchange Semiconductor Index, a key benchmark for chip stocks, fell 1.09% (32.76 points) to close at 2977.39 on the 15th.

Screenshot from Oriental Fortune

According to MarketWatch, Christopher Rolland, an analyst at Susquehanna Financial Group, pointed out in a report on Wednesday that the semiconductor industry's delivery time (from ordering to delivery of chips) has been shortened for 9 consecutive months, indicating that the "core shortage" crisis caused by the epidemic has become history since the second half of 2020.

Rolland pointed out that the current delivery time in the semiconductor industry is four weeks lower than the historical peak in May 2022. According to his prediction, the actual delivery time may be shortened faster because distributors are unwilling to reduce the delivery time due to concerns about customer order cancellation.

In terms of relatively popular brands, Rolland stated that the delivery time of Microchip has been significantly shortened, and the delivery time of FPGA chips produced by Celestine has dropped sharply in the past few months. "In this financial quarter, we learned from many companies that the supply of FPGA has been improving. This contraction may also indicate that the network terminal market dominated by FPGA may be slowing down."

In addition, Rolland stated that although the delivery times of broad-based suppliers such as Microchip, TI, and NXP are rapidly declining, the delivery times of Italian French Semiconductor, Infineon, and Ansemy Semiconductor are more stable.

Note: The source and copyright of the text belong to international e-commerce information, and Jurmay Technology is only for reproduction and enjoyment.