Where is the paradise of China's chip industry, on the flight to Shenzhen? Or in Huaqiang Beili, where the myth of wealth creation has repeatedly emerged?

Distributors are also the darling of capital and market

Shenzhen, the first industrial city in China, was in March 2023, with warm spring and blooming flowers, a crowded population, and an unprecedented congestion of people and vehicles in the streets and alleys. Flights were fully loaded, hotels were crowded, and restaurants were hot. A scene of prosperity was filled with wine and wine. Behind the bustle is the decline in orders in the chip industry, sluggish demand, inward pricing, high inventory, frequent layoffs, and closures; The end of the era of chip highlight has raised deep anxiety in the chip industry chain; After all, after three years of the pandemic, there is no lying down and no excuse. What should I fill in the blanks with?

Brand terminals, electronic manufacturing, solution providers, and other businesses are bustling, and even component distributors are also welcoming and seeing each other with unprecedented excitement. It is no wonder that Shenzhen is the headquarters of chip distribution, and more than 70% of China's local distribution enterprises, including Huaqiang North, are deeply rooted here. On February 3, 2023, the International Trade Center for Electronic Components and Integrated Circuits, led by China Electronics and Shenzhen Investment Holding, and sponsored by multiple component distributors such as China Electronics Hong Kong, was also established in Qianhai, Shenzhen. It is committed to creating a trillion-level international trading market for electronic components and integrated circuits, and focuses on improving the resilience and security of the industrial chain and supply chain.

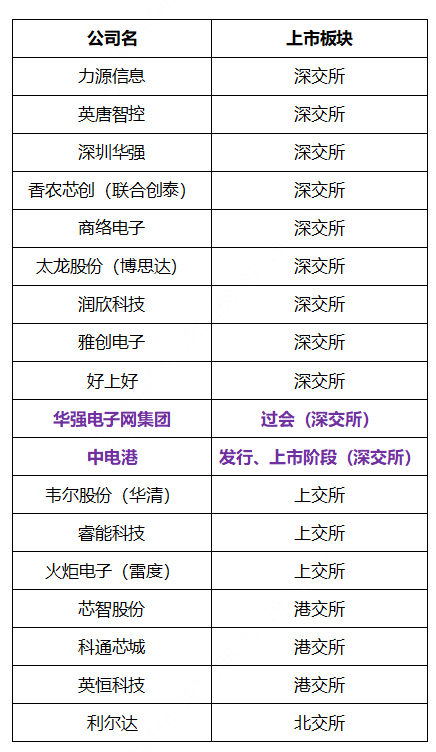

On October 31, 2022, Hershey's main board was listed, and a total of 16 mainland local distributors from Hong Kong Stock Exchange, Shenzhen Stock Exchange, Shanghai Stock Exchange, and Beijing Stock Exchange landed on the capital market. On December 22, 2022, Huaqiang Electronic Network Group, which focuses on the concept of component internet, held a meeting; On March 13, 2023, Zhongdian Port (001287), the largest component distributor in Chinese Mainland, passed the conference, becoming the first batch of enterprises to pass the conference since the registration system. On March 28, online and offline subscriptions were launched, refreshing the listing speed of distribution enterprises again!

In the era of inventory, the controversial "mover" - component distributor, born under heavy loads and kneeling down, is still the darling of capital and national policies? The level of achievement that distribution can achieve has always been related to chip timing. Let's review the growth history of component distributors first.

Official history of distributors

"We are committed to bringing the value of technology to more people - this is the latest version of the mission vision of the global electronic component distribution leader, iRui Electronics. This statement also reflects the value direction and core competitiveness of a new generation of excellent component distributors.".

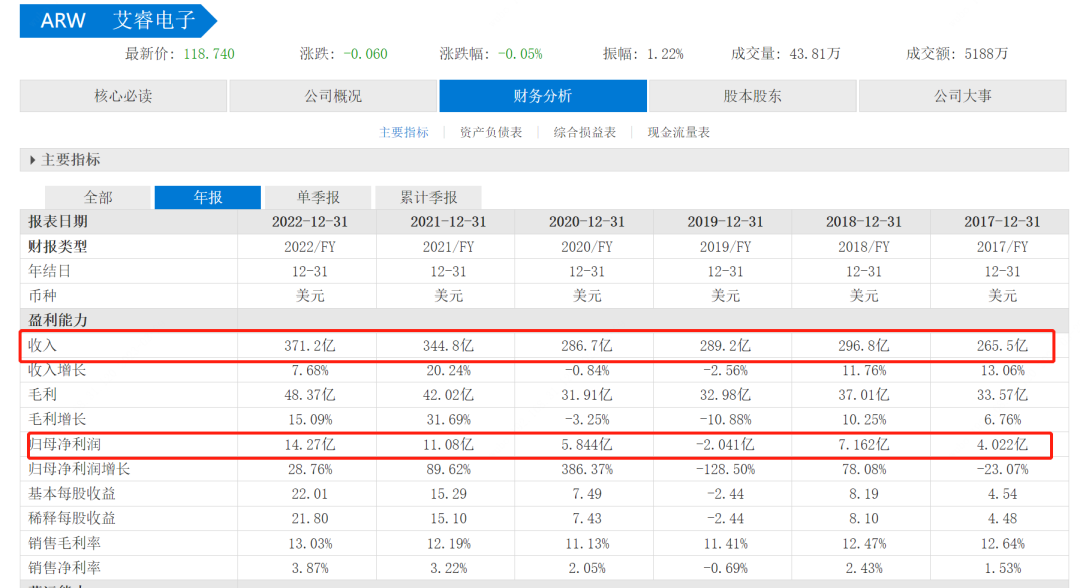

In 1935, iRui Electronics was born. During the nearly 100 years of "falling in love and killing each other" with Anfuli, it has built up a solid foundation with advanced strategic layout and long-term strategies. Its industrial matrix of authorized distribution, e-commerce, spot goods, trade, media, and data services is complete and complete. Under Tianluodi Network, the original factories all love and add. In 2022, its sales reached 37.12 billion US dollars (Oriental Fortune Network data), becoming the world's number one for many consecutive years.

Figure: Data from Oriental Fortune Network

The decades of prosperity and prosperity of the semiconductor industry in Europe, America, Japan, and South Korea cannot be separated from the full cooperation and global support of distributors. Whether it is authorized agents such as iRui Electronics, Anfuli, Macnica, Fuchang, and Ruzhuoli, or directory distributors such as Dejie Electronics, Trader, TTI, Rochester, and Oushi, as well as independent distributors such as Smith and A2 Global, they are all pioneers and best helpers in the field of chip attack in Europe, America, Japan, and South Korea.

Benefiting from the industrial transfer dividend of the global electronic OEM manufacturing industry, distributors in Taiwan, China, China, have sprung up along the trend, emerging excellent distribution enterprises such as the Grand Lianda, Wenye Technology, Yideng International, Weijian, Zengyouqiang, etc. These distributors have gradually become the industry leader and the second largest distribution force by quickly and closely serving the local EMS, OEM, and ODM manufacturing industries, as well as through integrated mergers and acquisitions.

In the process of transferring the global semiconductor industry chain and moving the manufacturing industry eastward, these distributors closely follow the pace of their original factories in the global layout, serving multinational enterprises as well as local well-known and fast-growing enterprises, achieving mutual achievements, setting off each other, cooperating with each other in a tacit understanding, and having a clear division of labor (some doing 0 to 1, some doing big customers, some doing spot goods, and some doing cold stops), infinitely expanding the profit space of technology and applications, Control and influence are everywhere, achieving decades of mutual dividends and predestination.

In general, in addition to warehousing and distribution, capital chain services, experienced electronic component distributors can help upstream chip design manufacturers complete most market development, product promotion, and technical support services, while helping downstream customers shorten product development cycles and reduce development costs. In addition, distributors, due to their rich customer resources, can help the original factory obtain more accurate customer demand forecasts and assist customers in completing product and technology design work. With the rise and innovation of e-commerce platforms, some electronic component distributors have also continuously improved the transparency and timeliness of product information through the establishment of e-commerce platform data, thereby improving the efficiency of distribution business.

China distribution PK global giants

The rise of component distribution in Chinese Mainland benefits from the era background of reform and opening up. With the continuous eastward movement of the global electronic manufacturing industry, China's 1 billion+giant artificial depressions have become the hot spot of the global OEM industry. In the early 1980s, the "three processing and one compensation" process took the first step in the project construction, import and export, and supporting business of components (China Electronics Corporation, China Electronics Technology Import and Export Corporation, China Electronics Equipment Corporation); In the late 1980s, marketization began with the establishment of component trading desks in Huaqiang Beisaige Group. Many well-known distributors that we are familiar with today have sprouted in this treasure land of feng shui, and now they are avoiding it.

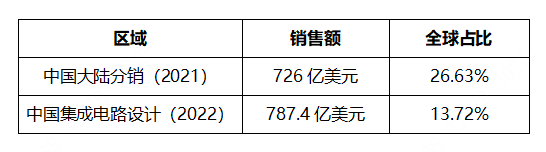

After nearly 40 years of cultivation, Chinese component distribution has finally become one of the important members on the world stage.According to the 2021 statistics of the official account "Chip Master" Research Institute, the cumulative sales of Chinese local component distribution enterprises with a sales volume of 1 billion yuan+scale is about 289.54 billion yuan. In addition to the trade distribution data of other local agents and Huaqiang North, the cumulative amount is about 500 billion yuan, amounting to about 72.6 billion dollars.

According to the statistical data of International E-Commerce, in 2021, the total amount of Top 50 distributors outside Chinese Mainland will be about 158.955 billion US dollars, and in addition to the data of Fuchang Electronics and other distributors around the world, it will be about 200 billion US dollars.

According to the statistics reported by Professor Wei Shaojun and the SIA of the United States, the global share of China's integrated circuit design industry is about 13.72% (US $78.74 billion/US $57.35 billion). Correspondingly, the component distribution in Chinese Mainland accounts for 26.63% of the global distribution (72.6 billion US dollars/27.2 billion US dollars), and the development speed of China's distribution is ahead of that of the IC independent design industry.

China Core Incubator and Booster

According to the data of SIA (American Semiconductor Industry Association), the global semiconductor sales amount reached 573.5 billion US dollars in 2022. According to the sales situation of the design industry reported by Wei Shaojun, the chairman of the Integrated Circuit Design Branch of the China Semiconductor Industry Association, the industry wide sales in 2022 is expected to be 78.74 billion US dollars. The huge gap between these figures is due to the fact that in addition to fundamental factors such as talent, products, and technology, there is significant room for improvement in cooperation with distributors.

As we mentioned earlier, the globalization of the chip industry in Europe and the United States benefits from a reasonable and efficient industrial division and the full support of distributors. At the same time, we can see that in the process of learning and competing with world-class competitors, local distributors in Chinese Mainland have the ability to distribute and serve all key chips (CPU, GPU, AP, FPGA, DSP, ADC/DAC, etc.). These capabilities will help China Core expand its territory, rapidly strengthen its global operation capabilities, and calmly cope with the impact of the outward migration of manufacturing industry on the industry.

Through public information, we have seen a significant increase in the proportion and share of domestic chips distributed by China Power Port, Haoshanhao, Shenzhen Huaqiang, Yingtang Zhikong, and others. In particular, China Power Port, where the proportion of domestic distribution has exceeded 50%, has become the flagship of China Chip promotion! At the same time, more and more Chinese chip companies are expanding their brand awareness through the Internet, rapidly increasing their 0 to 1 occupancy rate and industrial efficiency. More spot and even distribution traders are using commercial logistics to support national small and medium-sized enterprises, research institutes, and maker groups in the Pearl River Delta and Yangtze River Delta.

That is to say, through increasingly rational industrial division of labor, the right distribution group in Chinese Mainland has actually undertaken the complex role of China Core incubator, booster, reservoir and lubricant, becoming the pioneer of globalization and the hope and backbone of "the whole village".

Digital Pioneer

Due to the large number of customers and suppliers, electronic component distributors have a large daily order volume and diverse transaction modes. Their business involves a large number of order management, stock management, inventory management, logistics management, fund settlement, etc., with a large amount of transaction data and high transaction frequency. Therefore, electronic component distributors need to have strong data information system support, mainly including ERP systems, WMS systems, data analysis systems, CRM systems, OA office systems, etc., to handle large amounts of data in daily business, so the digitization of distributors is imperative.

At present, distributors that have undergone digital transformation mainly come from Chinese Mainland and North America, which are also the most important component distribution markets in the world. On the contrary, distributors from Japan and Taiwan, China have lagged behind in the wave of global digital transformation. Traditional distributors such as Fuchang Electronics, Airui, Anfuli, and Zhongdian Port actively build e-commerce platforms to help upstream and downstream enterprises make accurate and scientific decisions, optimize resource allocation, and stabilize and smooth supply channels through data empowerment industries. Many new industrial internet e-commerce platforms such as Lichuang Mall and Core Inspection have formed industry competition barriers to serve local small, medium, and micro customers and needs through various entrances such as PCB/PCBA, spot, matchmaking, and data.

Of course, we should recognize that in the process of digitizing the component supply chain, the component distribution model dominated by transaction services cannot fully cover the needs of the electronic industry to improve the supply chain and collaborative manufacturing efficiency, and does not truly reach the deep service level of "full industry interconnection", that is, the comprehensive penetration ability to extend upstream and downstream. Supply chain digitization needs to give full play to the data potential of industrial service platforms, integrate industrial resources on the basis of win-win cooperation, comprehensively promote the electronic industry to quickly complete the process from transaction&service to digital supply chain, and become an important force in promoting technological innovation.

With the east wind blowing and the battle drum beating, distributors, like original factories such as TI Store, are keeping pace with the times on the path of digital transformation, upgrading, and efficiency enhancement. They are determined to forge ahead, overcome obstacles, and walk at the forefront of the innovation camp.

Supply Chain and Lifeline

Under normal supply and demand relationships, electronic component distributors can participate in customer development work from the project initiation and evaluation stage, providing customers with various supply chain services such as demand analysis, technical performance matching, process stability, supply stability, product selection, procurement solutions, warehousing, finance, cost reduction and efficiency enhancement, and providing solutions with a high degree of adaptability by providing technical and application support services. This benign supply chain hub relationship ensures long-term and stable cooperation between the original factory and downstream customers, and plays a positive role.

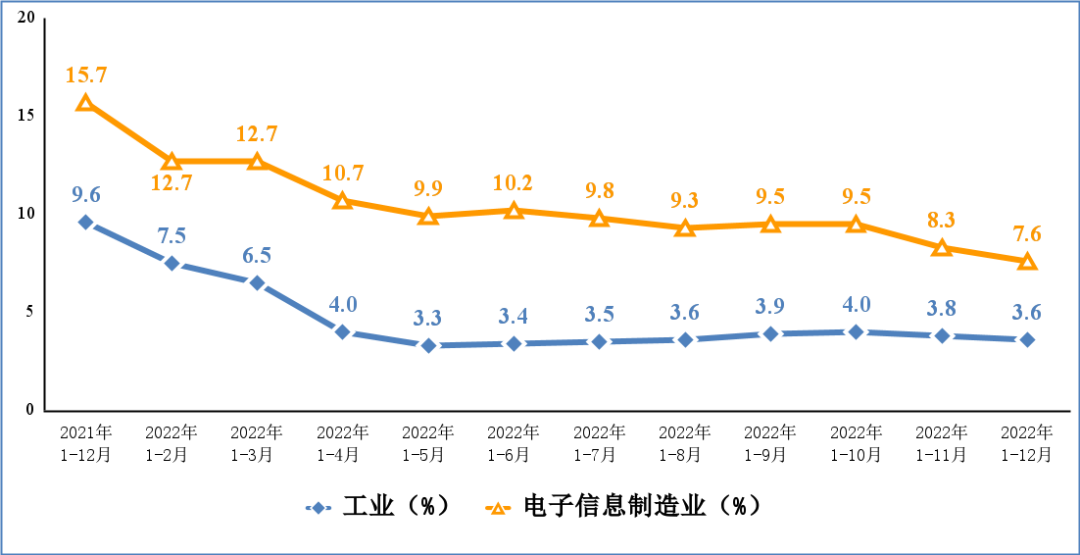

However, with the Sino US trade friction, chip supply failure and the 3-year COVID-19 epidemic and other factors fermenting, the chip supply chain problem has gradually become the lifeline of China's electronic information industry. In terms of supply, due to the abnormal development of the industry, there has been a shortage of global supplies of medical care, automobiles, new energy chips, etc., resulting in significant price fluctuations, and the delivery time has been continuously lengthened. On the demand side, with the COVID-19 raging around the world, the downstream end product market of electronic components has been impacted, affecting the procurement demand of electronic information manufacturing industry for original manufacturers, and the growth rate of China has dropped sharply.

Source: official website data of the Ministry of Industry and Information Technology

Due to the intensification of uncontrollable factors, as well as information asymmetry and human factors, component prices have skyrocketed and plummeted, causing all parties in the industry chain to suffer and be overwhelmed. Therefore, one of the core functions of the newly established international trading center for components and integrated circuits is to ensure the stability and safety of the supply chain, and security has become the highest level in the industry. In the context of the industrial chain being cut and cut off at any time, the importance of distribution to ensure the stability and safety of the supply chain has been raised to a new height.

As the world's largest consumer of electronic components, with the increasing variability brought to the supply chain by the game between China and the United States, more and more local manufacturing enterprises are choosing domestic chips as "spare tires" or even major suppliers, serving as a bridge between upstream and downstream, as a messenger to go abroad, and further highlighting the value of the industrial chain of local electronic component distributors. At the same time, as China's policies increase support for the chip industry, and domestic enterprises improve their design, production, and manufacturing capabilities, domestic chip product lines gradually enrich, product quality improves, product performance improves, and product competitiveness increases. This will also feed back the competitiveness of distributors, forming a virtuous circle for China's chip industry.

New distribution, new value

The peacock is flying south (southeast), and the person on the core is chasing it! Whether it's Beijing, Shanghai, or Shenzhen, Beijing, Shanghai, or Shenzhen, this is an iron triangle combination of design, manufacturing, and distribution in China's chip industry chain, and a golden combination of closed-loop supply chains. The fundamental reason why American chips are powerful, enduring, and talented is that they fully value the value of distributors and their position in the market. On the basis of mutual fault tolerance, they do a good job in industrial division, which is the pattern of first-tier cities and the leading enterprise strategy. At the same time, we should also fully realize that in the high-risk context of increased risk of trade friction and fragmentation, if overseas supply chains are forced to cut off, who can be entrusted with the important task of continuing the path of life, except for local distributors, can we count on?

Head cluster distributors and e-commerce agents and services have a large number of product lines. With reasonable scheduling through a database, they can meet and cover the main needs of customers' BOM, assist customers in the replacement design of product solutions, and even enable analysis and prediction of industry prosperity indicators through customer portraits, traffic analysis, purchasing behavior, and other data, helping the original factory do a good job of product demand analysis and capacity planning. Many small and medium-sized distributors can grow together with small and medium-sized chip manufacturers through focus and professional services, and the landscape goes one way after another.

On March 24, 2023, Shenzhen Bao'an District issued the "Implementation Plan for Cultivating and Developing Semiconductor and Integrated Circuit Industry Clusters in Bao'an District (2023-2025)" policy: Actively promote the construction of an international core creation port, introduce world-renowned semiconductor and electronic component agents and distributors, establish a customs, tax, financing, foreign exchange and other policy system for semiconductor and electronic component distribution and settlement, and create the most centralized and dynamic policy system in the Asia Pacific region The lowest transaction cost distribution center for semiconductor and electronic components. Gather application research and development centers of the world's top semiconductor manufacturers to carry out business such as scheme design, talent training, application research and development, exhibition and promotion, and create a globally influential semiconductor application research and development ecosystem with highly concentrated industrial chains and efficient supply chain collaboration.

Previously, the International Trade Center for Components and Integrated Circuits was established, followed by policy support from Bao'an District. New distribution creates new value, allowing the value of technology to benefit more people. Highly dynamic component distributors have gradually become one of the engines for the development of China's integrated circuit and electronic information industry. This is the golden era of distribution in China, and it is also a golden opportunity for Chinese integrated circuits to lead new distribution to globalization. Let's wait and see!

Note: The source and copyright of the article belong to the chip master. Jiemai Technology is only for reproduction and sharing.