The consumer electronics, industry, automobile and communication sectors have jointly supported a large part of the semiconductor industry. However, due to the impact of the economic cycle, almost only the new energy market remains in the terminal market of semiconductors, especially the new energy automobile industry.

After the explosive growth over the past two years, the inventory of components increased, the downstream demand began to weaken, and consumer electronics entered a dormant period. The high-profile MCU has also encountered some new changes.

Consumption left, car right

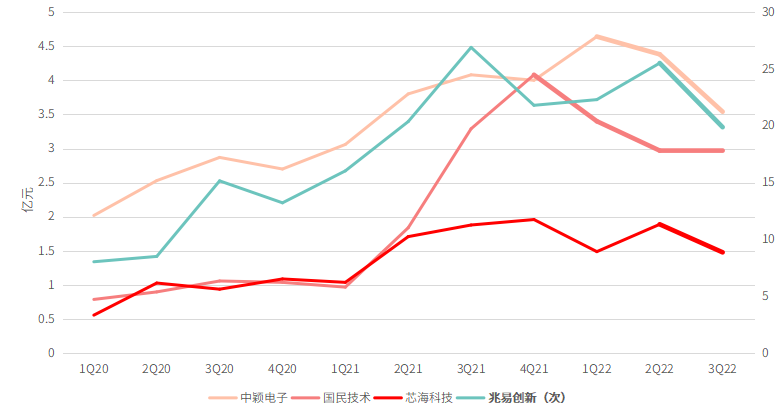

From the perspective of revenue, after two years of rapid growth, the revenue of domestic MCU enterprises began to decline after entering 2022. The revenue of several domestic MCU enterprises, including Mega Innovation, Zhongying Electronics, National Technology and Core Technology, was declining on a month-on-month basis.

Looking at the revenue of the whole 2022 year, according to the performance forecast disclosed by various enterprises at present, the annual revenue of Zhongying Electronics is between 360 million and 380 million yuan, with a year-on-year change of - 2.9% to 2.5%; The net loss of national technology ranged from 23 million yuan to 33 million yuan, from profit to loss; The deduction of non-net loss was 105 million yuan to 115 million yuan, because the demand of the downstream integrated circuit market shrank in stages and the product sales price was under pressure, resulting in a year-on-year decline in the sales revenue and gross profit of the integrated circuit business; Core Sea Technology's net profit in 2022 was 11 million yuan, down about 88.50% year on year. Although the annual revenue range has not yet been announced, the revenue of the first three quarters of 2022 reached 6.769 billion yuan,+6.94% year-on-year, and the revenue growth slowed.

Corresponding to the downturn of the consumer market is the boom of the automobile market. According to Infineon's latest financial report, its revenue from automotive MCU in 2022 was 1.573 billion US dollars, up 88% year on year; NXP's revenue from automobiles was US $6.88 billion, up 25% year on year, and NXP mentioned in its financial report that due to the rapid growth of new energy vehicles in China, there was a backlog of orders for automobile chips in China. In addition, Renesas's revenue from automobiles was $4.935 billion, up 42.93% year on year.

From the perspective of the domestic market, according to the statement of IVTU in the investor platform, the MCU of its subsidiary, GEFAC, is operating well. By the third quarter of 2022, the revenue has increased nearly three times year-on-year. As the golden race track, domestic MCU enterprises have been accelerating the layout of vehicle-level MCU in the past year.

Embrace the new energy dividend, and accelerate the domestic vehicle's standard MCU

Previously, domestic MCU enterprises mainly focused on consumer electronics, with few layout in the field of vehicle-level MCU. However, after entering the second half of 2020, the new energy vehicle industry began to show explosive growth, and the demand for automotive MCU also increased rapidly.

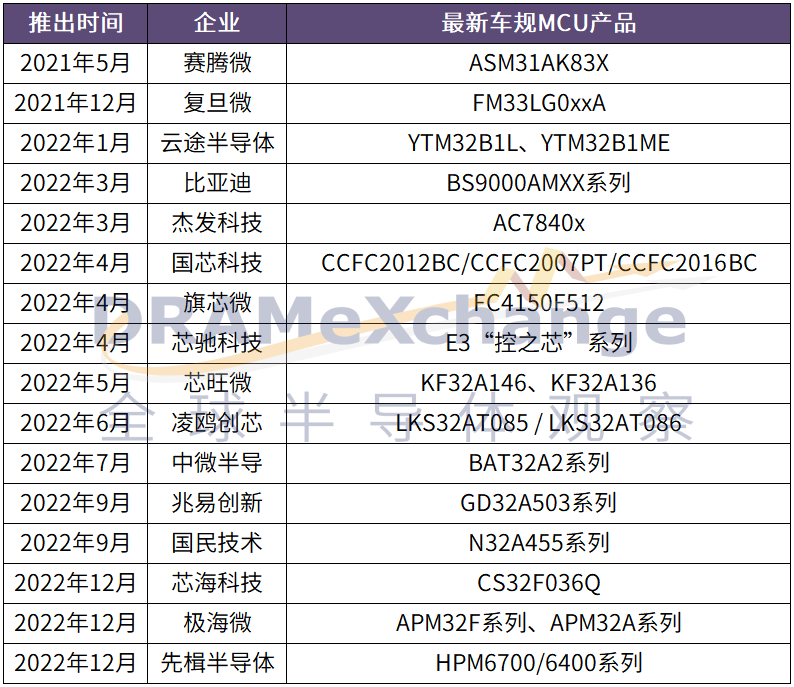

On the one hand, due to the burst of demand, domestic enterprises have accelerated the layout of vehicle-grade MCU. In the past year alone, nearly 20 enterprises have launched vehicle-grade MCU products, some of which have passed the certification, some of which are still in the process of certification, and a small number of vehicle-grade MCU products have been launched.

In addition to the shortage of vehicle MCU caused by the demand explosion, which has brought development to local MCU enterprises, domestic substitution also provides opportunities for the development of domestic vehicle MCU.

Domestic automobile enterprises began to actively contact domestic MCU enterprises, especially those with mass production capacity. On the one hand, it is to ensure the safety of the supply chain and improve the autonomy and controllability of new energy vehicles. On the other hand, it is also to lock part of the production capacity in the context of capacity shortage, and to supplement the supply system dominated by NXP and Renesas.

For domestic MCU enterprises, this is the golden window to enter the automotive MCU market, and it is also the second growth curve.

Multi-factors are intertwined, and efforts are needed in the short term, but there is pressure in the long term

In the long run, new energy vehicles have huge development space. At present, countries around the world are actively promoting new energy vehicles, and automobile enterprises are also transforming. Looking back from the long-term to the current 2023, the growth of new energy vehicles may slow down.

In the past two years, new energy vehicles have entered an explosive growth. According to the data of the China Automobile Industry Association, the sales of new energy passenger vehicles in China in 2022 was 6.887 million, an increase of 3.366 million from 3.521 million in 2021, almost doubling. However, explosive growth is bound to be only temporary, and the growth rate will slow down later.

Recently, the sales volume of new energy passenger vehicles in 2023 is expected to be 9 million, an increase of 2.1 million compared with 2022, which is lower than 2022.

The slowdown of terminal market growth also means that the demand for upstream semiconductors will also slow down, and the imbalance between supply and demand may be solved. For the short-term development of domestic automotive MCU, 2023 will be very critical, because the golden window period is closing. Being able to successfully mass produce and enter the supply chain of automotive enterprises through certification means entering the door of the automotive MCU market. If there is no mass production or entering the supply chain of automotive enterprises, the future will be more difficult than today.

From the short and long term of vehicle MCU, the transition from traditional fuel vehicles to new energy vehicles in the short term, the improvement of intelligence makes the consumption of single vehicle MCU increase. In addition, users' requirements for comfort will also increase the amount of MCU.

In the long run, the electronic and electrical architecture of new energy vehicles is also changing. Domain and domain controllers promote the development of the electronic and electrical architecture of vehicles from distributed to centralized. The main engine factory is accelerating the layout of centralized electronic and electrical architecture. Under this trend, multiple functions in the vehicle are integrated to reduce the consumption of MCU. On the other hand, there are higher requirements for the performance of MCU. At present, a number of international MCU manufacturers including Infineon and NXP are upgrading the MCU from the previous 40nm process to 28nm and below.

When the sand blows out, the gold is still in the field

The year around 2021 is the golden age of domestic semiconductors, and also the golden age of start-ups. The shortage of production capacity, the localization of semiconductors and the explosion of new energy vehicles have triggered the capital market and brought a lot of hot money to semiconductors. Many start-up semiconductor enterprises have successively won the favor of investors.

However, for the MCU industry, this is not a 100 billion track with huge imagination. After more than half a century of development, the industry itself has become very mature, and the market pattern is fixed. There must be very few people who can break out eventually.

Now, the tide of capacity shortage is fading, the consumer market demand is flagging, and terminal manufacturers are trying to de-stock. In 2023, the MCU market officially entered the era of big waves and sands. For those enterprises that have not yet the ability to ship in batches and stabilize customers, it may finally become the sediment of the era. The enterprises that can stay will continue to face fierce competition without end.

Note: The text is reproduced to Global Semiconductor Observation for sharing only.